Building a Partner Big Idea - Part 3 - Setting up the Right Offer

There’s a way to ensure their first offer is their best

The MBP centers on the Partner Big Idea (“PBI”). This three part series is a deep dive into their development.

Part 1 is (here): Opportunity + Methodology + Execution

Part 2 (here): Economics + Two Line Model (“TLM”)

Part 3 (here we go): Market Leadership Positioning (“MLP”) + value framework + setting up the right offer

As I said in Parts 1 and 2 this is a fictional scenario. Any overlap with happenings in the real world is coincidental. Also, I’m distilling the development of a startup M&A thesis down to its essence, so I make all kinds of simplifying assumptions and skip over any number of details. What I want to transmit to you is the “feel” of how these things go, so that you have a head start in handling the situations that present themselves to you.

As I’ve said in the prior posts, this is all a “way of thinking.” It’s intended to give you an approach that you will almost certainly adjust in practice. In your case things may be shorter, longer, fatter, or skinnier. It will flex based on what seems achievable and best fits your context. Don’t worry if it doesn’t make sense to do all the parts I describe - I’m trying to give you an example framework, one that you can then improvise with, and hopefully improve upon!

The PBI

A lot has gone into building this PBI, so it’s important to read the first two parts of this series before diving into this part three! But to get us pointed in the right direction, let’s do a brief recap. BigResearch is a large diversified research company that studies complicated things for giant clients. DocT3c is a startup working on advanced AI for language processing.

Together they’ve developed the framework for a powerful PBI: Aligning key market forces; accounting for BigResearch’s major concerns; and determining how best to leverage DocT3c’s technology and expertise.

DocT3c is catalytic to BigResearch’s unlocking of the power of AI. They’ve mapped out a long-range and far-reaching strategy. In short, they’ve created a lot of purple boxes - with DocT3c’s red box right at the center of them.

DocT3c’s CEO has artfully crafted the Two Line Model (“TLM”) and articulated the enormous impact this PBI will have on BigResearch’s business.

Now it’s time for DocT3c’s CEO to pull this all together and ensure BigResearch fully appreciates how acquiring DocT3c will move them into a dominant market position, thereby significantly increasing shareholder value. By extension he also wants BigResearch to make their maximum offer to acquire DocT3c, an offer that acknowledges the critical role DocT3c will play in their future. In this Part 3 of the PBI series we are going to lay out the moves DocT3c’s CEO needs to make to ensure BigResearch develops that strong offer.

Tight linkage

Through the TLM process DocT3c’s CEO carefully linked DocT3c’s capabilities to the critical variables that power BigResearch’s significantly improved performance in combination. Propelled by the giant head start BigReseach will realize through the acquisition of DocT3c they will expand their TAM, increase the number of projects on which they can bid, improve their win rate, increase revenue per customer and improve the efficiency of project delivery.

Together the teams have developed a robust execution strategy and it’s through that strategy that it has become clear to BigResearch that to make this all work they needed to acquire DocT3c. A partnership or a licensing arrangement just isn’t going to cut it, they needed to own the platform and capture the full attention of the entire team.

Startup M&A is a revelation

Let’s stop and make a highlight on this point. Many startup founders wonder how they can move a conversation with a potential strategic partner (“PSP”) out of the “friendzone” (partnership, or license agreement, or…) and into M&A. The reality is you probably can’t (at least not while maintaining a position of strength). The need for the PSP to acquire your startup is instead “revealed” to the PSP through the development of the PBI. By carefully constructing the Opportunity, Methodology, Execution, and Economics layers of the PBI the strategy will build up the gravitational pull required to consume your startup. It will become clear to the PSP that acquisition is the only way forward. You are working to create a revelation, not pressing to force a decision.

The PBI gains momentum

Startup founders often fret about their inability to get senior executives at target PSPs involved in M&A conversations. They have access to enthusiastic mid-level players, but just can’t seem to break through to the executives with the organizational juice to sponsor an acquisition. The Magic Box Paradigm PBI process offers the solution. A well constructed PBI build’s organizational involvement, and in doing so compels an increasing amount of senior executive input. It builds intellectual mass as the layers of the PBI are formed. By requiring input from across the organization it elevates itself onto the visible horizon of PSP senior executives.

Remember business is a battle of ideas, and there’s lots of good ideas out there. This means the PBI needs to outcompete them all. It has to be the best. In a world of competing priorities, it’s not enough to just be visible, you have to be urgent. A well constructed PBI will almost certainly have greater depth and breadth than other potential strategies. And because it includes making an acquisition (vs. the other PSP ideas that probably start from scratch, and will take a while to mature) the return on investment from the PBI will be realized sooner!

You want this sponsorship, urgency, and scale to translate into a strong valuation.

Setting up an outperforming offer

A PSP’s offer to acquire your company should come at the end of the value creation process, not at the start. You want the first offer to be close to the max they would be willing to pay and you want it to incorporate every aspect of the PBI. This PBI is going to move the PSP into the premier market position, it’s going to lift their enterprise value. Making this move is urgent because your startup is a perfect and unique fit. Everything from your technology to your corporate culture align with the PSP. The future is at stake and you are the key that unlocks it.

To the victor go the spoils

DocT3c’s CEO realizes that now is the moment to pull it all together. The PBI is almost fully formed. But what does the PBI really mean to BigResearch?

It means that BigResearch is going to establish the leadership position in the market. They are going to be Coke, not Pepsi, and most certainly not Fanta. DocT3c’s CEO develops the Market Leadership Positioning (“MLP”) that’s going to explain the power of the PBI and how it will catapult BigResearch to #1.

#1 sets the market narrative

DocT3c’s CEO begins to develop the MLP document. He takes the lead in its preparation, but he also wants it to be a collaborative creation so he seeks input from BigResearch’s team wherever he can.

The first thing he frames is the market power accreted to the #1 player. #1 controls the narrative. They have the strongest brand, fastest growth, and biggest technological advantage. #1 controls pricing, attracts talent, and wins the jump balls.

DocT3c’s CEO reaches out to various BigResearch execs to discuss how they view market leadership. He wants to make sure he’s using their vernacular in the articulation of this opportunity. He wants the MLP to speak their language. He also appreciates that this document should lean more qualitative than quantitative - it’s the story of BigResearch’s future.

MLP framework

DocT3c’s CEO opens the MLP with the key drivers shaping the market in which BigResearch operates. He then outlines the growth profile of the market, and includes the additional market categories that the PBI would enable BigResearch to reach. He then goes on to create a high level, ten year, projection of what portion of this expanded market the #1 player could reasonably expect to capture. He supports this projection by illustrating a case study from a related market where a company was able to establish a #1 position by leveraging next generation technology.

He layers on to this analysis a commentary on how moving fast will enable BigResearch to outmaneuver competitors in winning top customers. He closes the MLP with a summary of the secondary and tertiary benefits of market leadership. In particular, the market leader’s ability to set industry protocols, establish best practices, define vernacular, and a few other factors that collectively represent the “securing of the high ground” in the category.

The missing link

You want the value the PSP places on your startup to be a function of their improving position (not of your standalone metrics as a small company). Yet, it’s hard to make the leap from the developing PBI all the way to a discussion of PSP value creation. The MLP is the missing link between the creation of the PBI and the setup for an outperforming offer. It raises the altitude of the conversation up from the practical business implications to the larger strategic ones. However, there’s one more piece to move on the board to perfectly position yourself. You have to translate the PBI into their improving capital markets position. You need to show the change in the PSP’s future value so as to maximize their current view of yours. Said differently, you want your valuation to be the NPV of your contribution to their strategy, not the DCF of you as a standalone company. As with the linkage of your startup to the critical improvements in the TLM, you want to now link the PBI to their rapidly improving capital markets posture.

BigResearch value drivers

DocT3c’s CEO reviews the companies that market analysts tend to compare to BigResearch. He sees a few consistent patterns in the value drivers that influence how these companies are perceived by the market. He reduces his list of value drivers down to the six that seem to really power capital markets perception in this category: rate of growth, scale of revenue and profit, innovation and technology leadership, strength of brand, market share, and competitive moat.

The basket of comparable companies to BigResearch look like the following:

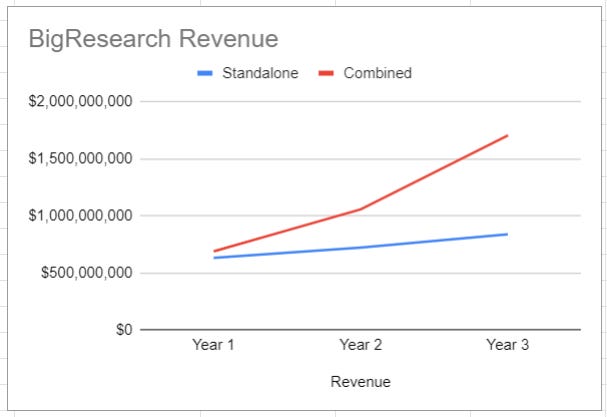

On its current course BigResearch can make a good argument that they are at least comparable to the average of this basket, putting their enterprise value multiple in the 1.2x revenue range. From the TLM it’s projected that on a standalone basis BigResearch will cross $800M in revenue three years out and with a 1.2x revenue multiple they’ll inch over the $1B enterprise value mark.

Movin’ on up

Now DocT3c’s CEO gets to work on articulating how, through the PBI, BigResearch can massively improve on this performance.