The Purple Boxes Framework

The most popular part of the MBP isn’t even in the book!

If you haven’t already - get the second edition of the MBP book here. Posts on MBP.co make a lot more sense if you’ve read the book!

I first introduced the Purple Boxes Framework (PBF) in my discussion of the right way to initiate conversations with potential strategic partners (PSPs). It seemed like a useful visual for helping people get oriented towards building Partner Big Ideas (PBIs). I went on to use the PBF (I’m adding the PBF acronym to the MBP lexicon!) as the framework for understanding bidding wars. In this context the PBF provided a crisp way to consider when, and when not, to attempt to introduce competitive dynamics into a negotiation.

Then something interesting began to happen, the MBP book and the PBF flipped. Rather than the PBF being a subordinate concept to the MBP, I started to get questions about the MBP in the context of the PBF! The PBF began to take on a life of its own. What started as a visual aid emerged as a popular conceptual framework. And it’s not even in the MBP book (at least not yet).

Given how pervasive the PBF has become, let’s do a deep dive on the framework and a few of its implications.

The Purple Boxes Framework

Lest we not forget, PBIs are, and will remain, the power source of the MBP. Well constructed PBIs are what create the opportunities for strategic relationships, investments, and acquisitions. But it can be hard to get the PBI ball rolling. How do you get conversations with PSPs off the ground, and keep them in the air?

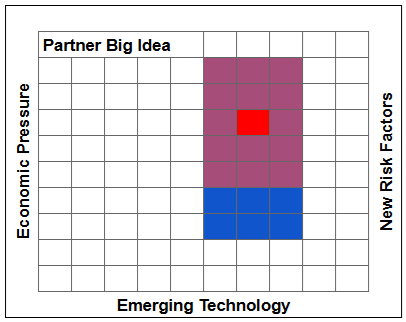

Where the Purple Boxes Framework (PBF) can help is as a framework you can use to get the PBI process moving. It starts with an articulation of the driving market forces creating the space for the new field of opportunity. At any time there are all manner of market forces at work in the world, some of those forces are highly relevant to the field in which your startup, and the PSP in question, are working. Identifying, and aligning, on those key market forces in your arena is how you set the frame for the Big Idea Landscape. These forces could be emerging technology (like AI), acute economic pressures (tariffs!), new risk factors (regulations), and so on. Job one is identifying and aligning on these forces with the PSP. Without such alignment, your conversation lacks context, and your ability to build a strong and enduring PBI is compromised.

Your startup, the red box, is operating in the Big Idea Landscape, and so is the PSP, represented by the blue boxes. It’s very easy to focus on the red and blue boxes, they have shape, mass, color. The traditional way of approaching opportunity formation would focus on describing all of the amazing attributes of the red box. Making the most compelling argument possible for its strength and prospects. However, for startups this traditional way doesn’t work.

In the startup game we’re trying to inspire transformational ideas. Ideas so big they power strategic partnerships, investments, and even acquisitions. For these big ideas the gold isn’t in the boxes that are already filled in, it’s the boxes that are yet to be.

What is the shape and size of the opportunities these market forces are unlocking? What is the new area that together your startup and the PSP can create? The PBI is represented by the purple boxes, which are a blend of the red and the blue - with the red box clearly situated at the center. The new, purple box opportunity space is massive, and it’s the red box (you) that unlocks it all.

Maximum leverage - be it in pricing or valuation - is achieved when the purple area is as big as possible and the red box is as central as possible. Said differently, you may help the PSP to envision a giant purple area, but if you’re not critical to unlocking it, it’s not going to help you much!

Purple boxes

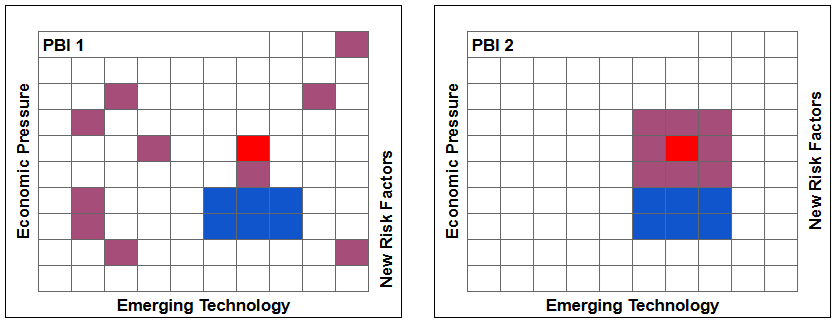

If you’re creating PBIs then you’re in the purple box business. You are creating new ideas that capitalize on evolving market dynamics. Ideas much bigger than your current efforts, but for which your current efforts represent the pathway to actualizing. The first thing to understand is that the big idea landscape is different for each PSP, and unique to each opportunity.

The scale of the PSP (blue), the location of your startup (red) and the PBI (purple) will shift based on the context of each situation. It’s not a one-size-fits-all endeavor, and you don’t want it to be. In this game you’re looking for the single outlier, the PSP with the PBI that eclipses all the others.

Consolidating the purple area

Startup teams are creative, and they see opportunity everywhere. However, this hyper-creativity can be a curse as much as it’s a blessing. You see 10 different ways a particular PSP could be improved through a collaboration with you. When building PBIs you don’t want a checkerboard of small ideas, you want to build one really big one. You want purple box density. PBI 1 in the following comparison is problematic. Many points of cleverness, but nothing big enough to sustain the weight of a significant strategic opportunity. Even though PBI 1 has more purple boxes than PBI 2 it’s a significantly inferior construct.

Find the purple area of greatest importance, and where your red box can feature most centrally, and build there. Note down all the other potential areas where your startup could help unlock innovation, but don’t feature those ancillary ideas in the body of the core PBI - that’s appendix material - the spice, but not the meat.

There are important structural reasons why this approach is critical. First, you’re not going to be able to simultaneously build full-blown PBIs for each of the disparate purple areas in PBI 1. So you’re going to end up undeserving each of them in a hope that the collection becomes meaningful, but this is a false hope, you’re just going to end up with a pile of parts and no whole. Second, it’s almost certainly the case that each of the purple areas in PBI 1 relate to different teams at the PSP, with different priorities, and different timelines. If you pursue a PBI like PBI 1 you’ve exponentially increased the number of people at the PSP who you’re going to have to shepherd through the PBI process. Third, as we discuss in the MBP book, the tipping point in the PBI process is when the PSP starts to take ownership of the idea, and organizational momentum builds. It’s when the PBI starts to create its own weather. When that weather starts to form, you want it to be one, giant, hurricane, not a bunch of little thundershowers.

Creating lots of little ideas can be fun, and it makes for a couple great meetings, but it lacks the gravity to hold a PBI together, and it lacks the density to go the distance. Move all the small stuff into a discussion of potential future expansion, and focus on maximizing the core.

The hole in the lobby

As a bit of a digression, but one that speaks to the criticality of consolidating the purple area, let’s note that strategic partnerships of any kind, and acquisitions even more acutely, are really hard. As I say in the MBP book, it’s a miracle any happen at all! A visual I like to use with my clients is to imagine there’s a giant hole in the PSP’s lobby. Every time someone walks into the lobby they have to walk around that giant hole to get where they’re going. Filling that hole occupies everyone’s mind at the PSP - it just has to be done.

That’s the measure of the criticality the big idea needs to have in order for it to power an acquisition. It’s a giant hole, and it has to be filled. Said in reverse, if you don’t sense that the PSP has a giant hole in their lobby, then there’s a good chance that this area of PBI development isn’t compelling enough to power a strategic opportunity.

Let’s take this line of thinking one step further. Let’s say, as the startup, you aren’t allowed in the PSP’s lobby. You know there’s something that’s bugging everyone just behind the front door, but you’re not exactly sure what it is. You are a filling, but you need to figure out if it’s a crack in the ceiling, a gap in the wall, or a hole in the floor that needs to be filled!

You’re very often going to be working with imperfect information. It may be that the PSP isn’t ready to fully reveal their problems and plans, but it may also be that those problems and plans aren’t even perfectly clear to them either. There’s a hole, they know that, but the exact shape and depth of it hasn’t been fully sussed out. It’s rarely the case that building purple boxes is a completely collaborative and fully transparent exercise. It’s more often an iterative process of inquiry and discovery.

And sometimes it turns out that what’s bugging the PSP isn’t a hole in the floor, but just a broken window. Big enough for them to be looking for a solution, but not even close to big enough to power a partnership or acquisition. Uncovering this early will help you determine how much you want to invest in the near term in this particular PSP conversation. If you’re just not relevant to their current priorities you’ll either have to work to change those priorities, or slow roll the conversation until their focus shifts to something closer to your efforts.

Criticality of the team

The PBF is about articulating a big and compelling future. It’s about building amazing new things. As such, you and the key members of your team are central to them. Let’s discuss why.